Solar photovoltaic power generation in the tax system

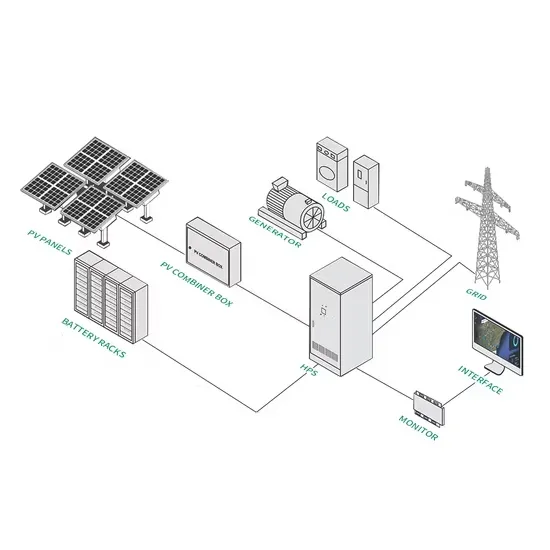

Welcome to our dedicated page for Solar photovoltaic power generation in the tax system! Here, we have carefully selected a range of videos and relevant information about Solar photovoltaic power generation in the tax system, tailored to meet your interests and needs. Our services include high-quality solar microgrid systems and battery energy storage solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Solar photovoltaic power generation in the tax system, including cutting-edge solar microgrid systems, advanced battery energy storage solutions, and tailored solar power storage applications for a variety of industries. Whether you're looking for large-scale utility solar projects, commercial microgrid systems, or off-grid power solutions, we have a solution for every need. Explore and discover what we have to offer!

Photovoltaic system

Figure 1. A photovoltaic system comprised of a solar panel array, inverter and other electrical hardware. [1] A photovoltaic (PV) system is composed of one or more solar panels combined

Product Information

Incentives for solar power generation systems

With a host of tax and incentive programs, there are many reasons for taxpayers to install solar power generation systems. The tax benefits can include income tax credits,

Product Information

Can You Deduct Solar Panels On Your Taxes? + FAQs

Qualifying systems include photovoltaic (PV) panels, solar water heating systems, solar turbines, and related equipment. Equipment must be placed in service during the tax

Product Information

Commercial Solar Energy Power Generation Ohio | YellowLite

One of the strongest financial arguments for adopting solar energy for power generation in 2025 is the availability of lucrative tax incentives. The federal government

Product Information

Navigating Tax Issues in Solar Energy Projects

Explore key federal and state tax issues in solar energy projects, including Investment Tax Credits (ITC), depreciation, and ownership structuring. Stay informed on the latest tax incentives and

Product Information

Solar Tax Credit Explained: Homeowner''s Guide to the Federal Tax

One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics, also known as the Investment Tax Credit (ITC). This credit can

Product Information

Regional feed-in tariff mechanism for photovoltaic power generation

Solar photovoltaic (PV) power generation is a leading renewable technology, offering minimal environmental impact, low carbon emissions, and high electricity generation

Product Information

How Does the Federal Solar Tax Credit Work for Businesses?

In this article, I''ll explain how federal solar tax credits work for businesses, who is eligible, what they cover, and additional benefits such as the production tax credit (PTC),

Product Information

Solar Tax Exemptions – SEIA

Property tax exemptions allow businesses and homeowners to exclude the added value of a solar system from the valuation of their property for taxation purposes. An exemption makes it more

Product Information

Solar PV Guidebook Philippines

Citation Fajardo, Jose Edmundo; Ruales, Marilou; Wilhelm, Bruno. 2014: Solar PV Guidebook Philippines: Legal and Administrative Requirements for the Development and Connection of

Product Information

The State of the Solar Industry

State-by-State Electricity from Solar (2023) Sources: U.S. Energy Information Administration, "Electric Power Monthly," forms EIA-023, EIA-826, and EIA-861. U.S. Energy Information

Product Information

Tax Benefits on Solar Power in India: A Comprehensive Guide

As India continues to transition towards a cleaner energy future, the tax benefits on solar power are likely to remain an important factor in driving adoption and growth in this sector. Note: It is

Product Information

Solar Investment Tax Credit: What Changed?

One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics, also known as the Investment Tax Credit (ITC). This credit can

Product Information

How to tax solar photovoltaic power generation | NenPower

Residents and business owners aiming to invest in solar energy should investigate their local government programs and resources to take full advantage of potential incentives,

Product Information

Residential Clean Energy Credit

If you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage technology, you may qualify for an annual residential clean energy tax

Product Information

Solar Power''s Game-Changing Tax Breaks: Current Government

For 2024, residential and commercial solar installations qualify for a 30% tax credit, which will maintain through 2032. This percentage applies to the total cost of the system,

Product Information

Rooftop solar power

A rooftop solar power system, or rooftop PV system, is a photovoltaic (PV) system that has its electricity -generating solar panels mounted on the rooftop of a residential or commercial

Product Information

Residential Clean Energy Credit

Property tax exemptions allow businesses and homeowners to exclude the added value of a solar system from the valuation of their property for taxation purposes. An exemption makes it more

Product InformationFAQs 6

What is the federal tax credit for solar photovoltaics?

One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics, also known as the Investment Tax Credit (ITC). This credit can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic (PV) system.

Can I claim a tax credit for a solar PV system?

This credit can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic (PV) system. The ITC increased in amount and its timeline has been extended. Those who install a PV system between 2022 and 2032 will receive a 30% tax credit.

Are solar power systems eligible for tax credits?

Tax credits: Regardless of their status as either a trade or business or a nonbusiness activity, solar power generation systems may be eligible for either an investment tax credit under Secs. 48 and 46 or a production tax credit under Sec. 45.

What are the tax benefits of solar power?

The tax benefits can include income tax credits, breaks on local real estate taxes, and enhanced depreciation of solar assets. However, the advantages extend beyond income tax incentives, as many states, power companies, and municipalities offer additional incentives, such as partial reimbursements or purchases of excess power generation.

What is a solar investment tax credit?

I. Federal Income Tax Issues. A. The Investment Tax Credit. The owner of a qualified solar facility may claim the investment tax credit (“ITC”). The ITC is a one-time credit against income tax that is based on the amount invested in a facility (rather than on the amount of electricity produced and sold).

Are solar power systems tax deductible?

Personal-use solar power systems are eligible for a federal income tax credit under Sec. 25D. This credit is available only for the taxpayer’s personal residence and equals up to 30% of the costs of qualified property installed. The cost of the system, net of the credit, forms the basis in personal property.

Related reading topics

- Lebanon Large Energy Storage Cabinet Wholesale

- Haiti Solar PV Inverter

- Lead-acid battery base station inventory

- Ukrainian power generation container house BESS

- Jamaica photovoltaic panel distribution and wholesale

- 1056 watts of solar energy

- Prices of photovoltaic panels in Turkmenistan

- New energy liquid-cooled energy storage battery cabinet assembly

- Guyana Green Energy Storage System Project

- 100w solar panel inverter

- Photovoltaic color solar panel transmittance

- Photovoltaic power generation and energy storage equipment company

- Mobile energy storage power supply equipment

- Cambodia Wacker Group Solar Cells

- Does the grid need energy storage

- Photovoltaic energy storage joint operation project

- Battery Cabinet Energy Density

- Nigeria 30kw high quality inverter manufacturer

- China-Africa Home Battery BMS System

- What is a communication signal base station

- Portable lithium battery emergency power supply

- Battery with photovoltaic inverter

- Greece Huijue Energy Storage Project

- UAE Energy Storage Photovoltaic Power Generation Project

- Battery cabinet waterproof and dustproof standards

- What are the special energy storage batteries in Nicaragua

- Benefits of Hybrid Compression Energy Storage Project