Customs classification of solar panels

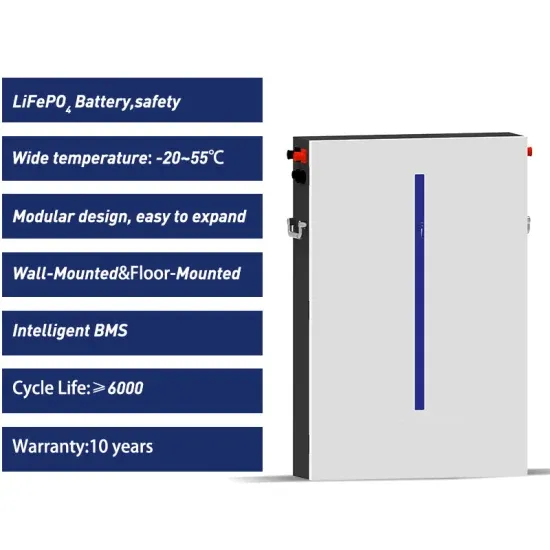

Welcome to our dedicated page for Customs classification of solar panels! Here, we have carefully selected a range of videos and relevant information about Customs classification of solar panels, tailored to meet your interests and needs. Our services include high-quality solar microgrid systems and battery energy storage solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Customs classification of solar panels, including cutting-edge solar microgrid systems, advanced battery energy storage solutions, and tailored solar power storage applications for a variety of industries. Whether you're looking for large-scale utility solar projects, commercial microgrid systems, or off-grid power solutions, we have a solution for every need. Explore and discover what we have to offer!

QB 22-507 Solar Cells and Modules 2022

Such duty shall be imposed on the declared value of such modules, including the cost or value of the non-cell portions thereof (such as aluminum frames), as Customs in its regulations or

Product Information

Duty-free solar panels classification in line with global standards

The Nigeria Customs Service (NCS) has again clarified that solar panels remain one of the items with free import duty in Nigeria as outlined by the World Customs

Product Information

CROSS Ruling

We initially address the classification of the subject solar panels. As stated within your request, the solar panels are incapable of supplying power directly to an external load, and the cells

Product Information

Solar Home System SCA Tariff Classification Judgement

The media release states that the issue before the SCA was whether a solar home system had the essential character of an energy source and power generation device or that

Product Information

OFFICE OF THE CHIEF COMMISSIOONER OF CUSTOMS

Attention of all importers, Customs Brokers and all stakeholders is invited to CBIC''s Instruction No. 08/2018 dated 06.04.2018 regarding classification of Solar Panels/Modules with elements.

Product Information

Customs Ruling NY N245909

Dear Mr. Gonzalez: In your letter dated August 27, 2013, you requested a tariff classification ruling on behalf of your client, Custom LeatherCraft Mfg. Co (CLC). The items under consideration

Product Information

Customs Ruling NY N338270

Based on the information supplied we note that all non-originating components/materials change to a new/different good within heading 8541, HTSUS, thus satisfying the tariff shift rule, as

Product Information

QB 25-507 2025 Solar Cells and Modules

In addition to reporting the Chapter 85 Harmonized Tariff Schedule classification for the imported merchandise, importers shall report the following HTS classification for imported

Product Information

Customs Ruling NY N231481

First, water is sprayed down the solar panel. This action dislodges pollutants from the surface of the panel. Then a mechanical cleaning arm traverses down the panel removing any foreign

Product Information

Section 201 – Imported Solar Cells and Modules

In his announcement, the President included an exemption for bifacial solar panels. This decision comes after the ITC recommended in November 2021 to extend the safeguard tariffs for an

Product Information

Circular No. 113/32/2019-GST F.No.354/131/2019-TRU

tion No. 1/2017-Central Tax (Rate) dated 28.6.2017, solar power-based devices and parts for their m nufacture falling under chapter 84, 85 and 94 attract 5% concessio

Product Information

Importing Solar Panels From China, India, and More

At the time of the investigation, solar panels from Southeast Asia made up 80% of supply in the United States, and exporters stopped bringing in more panels for fear of high

Product Information

Importing Solar Panels From China, India, and More

Learn the essentials of importing solar panels to the U.S., including regulations, tariffs, and how to choose the best solar panel exporter for your needs.

Product Information

Trade court orders retroactive duties on solar panels imported

At the time of the investigation, solar panels from Southeast Asia made up 80% of supply in the United States, and exporters stopped bringing in more panels for fear of high

Product Information

Customs Ruling NY N253737

This ruling is being issued under the provisions of Part 177 of the Customs Regulations (19 C.F.R. 177). A copy of the ruling or the control number indicated above should be provided with the

Product Information

OFFICE OF THE CHIEF COMMISSIONER OF

dispute has recently arisen regarding the classification of Solar Panel with Diode or other current regulating equipment''s / elements under Customs Tariff Heading (CTH) 8541 as against 8501.

Product InformationFAQs 6

What are the CBP regulations governing the import of solar panels?

Here’s a closer look at the key CBP regulations governing the import of solar panels: Harmonized Tariff Schedule (HTS) Classification: All solar panels must be correctly classified under the HTS to determine applicable tariffs and duties. Country of Origin Marking: The goods must be marked with their country of origin.

Do solar panels have to be Harmonized Tariff Schedule (HTS)?

Harmonized Tariff Schedule (HTS) Classification: All solar panels must be correctly classified under the HTS to determine applicable tariffs and duties. Country of Origin Marking: The goods must be marked with their country of origin. This is crucial for determining duties and creating transparency for consumers.

Will bifacial solar panels be exempt from tariffs?

In his announcement, the President included an exemption for bifacial solar panels. This decision comes after the ITC recommended in November 2021 to extend the safeguard tariffs for an additional four years. Proclamations

Do solar panels need to be imported into the United States?

When importing solar panels into the United States, importers must follow rules and regulations set by Imported solar panels must follow rules and regulations set by CBP. These regulations ensure that these products comply with U.S. standards for safety, efficiency, and trade.

What is the tariff on Chinese solar panels?

The tariff on Chinese solar panels started out at 25% of the product value, but has increased to 50% in 2024. Fallout from this tariff and the previously mentioned UFLPA has led importers to search for alternative sources.

Should solar panel importers be aware of Xinjiang's 'in part' law?

Solar panel importers in particular need to be aware of this, mostly because of the “in part” provision of the act. Xinjiang is currently one of the world’s top producers of polysilicon, a primary component of most solar panels.

Related reading topics

- Equipment required for energy storage box

- Battery capacity of container energy storage power station

- Which energy storage equipment is best in Saint Lucia

- Peru PV inverter requirements

- Battery discharge construction at communication base station

- How many watts is the maximum power of the Brazilian inverter

- Eastern European distributed energy storage cabinet manufacturers

- Which inverter to use for low power

- Nicaragua Outdoor Battery Power Bank

- Identification of solar photovoltaic panels

- Does the power inverter include batteries

- Does the inverter need to have a sine wave

- Solar power supply in Guatemala

- Field inverter 12v

- Portable Energy Storage Cabinet Model in Indonesia

- Ranking of Moldovan energy storage container companies

- Energy Storage Charging Pile Company

- Ecuador has completed energy storage projects

- Photovoltaic energy storage in Ethiopia

- Malaysia rooftop solar photovoltaic panels

- Prices of new photovoltaic panels in Ireland

- Photovoltaic energy storage planning

- Of flexible photovoltaic panels

- Container house self-generated electricity

- How many batteries are used for a 48v inverter

- Australia is using solar power to generate electricity for home use

- Communication Energy Base Station