Marshall Islands solar panel tax exemption

Welcome to our dedicated page for Marshall Islands solar panel tax exemption! Here, we have carefully selected a range of videos and relevant information about Marshall Islands solar panel tax exemption, tailored to meet your interests and needs. Our services include high-quality solar microgrid systems and battery energy storage solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Marshall Islands solar panel tax exemption, including cutting-edge solar microgrid systems, advanced battery energy storage solutions, and tailored solar power storage applications for a variety of industries. Whether you're looking for large-scale utility solar projects, commercial microgrid systems, or off-grid power solutions, we have a solution for every need. Explore and discover what we have to offer!

Maximize Your Savings: The Ultimate Guide to Solar Panel Tax Exemptions

Maximize your savings with solar panel tax exemption tips, federal credits, and state incentives. Learn to qualify and apply effectively.

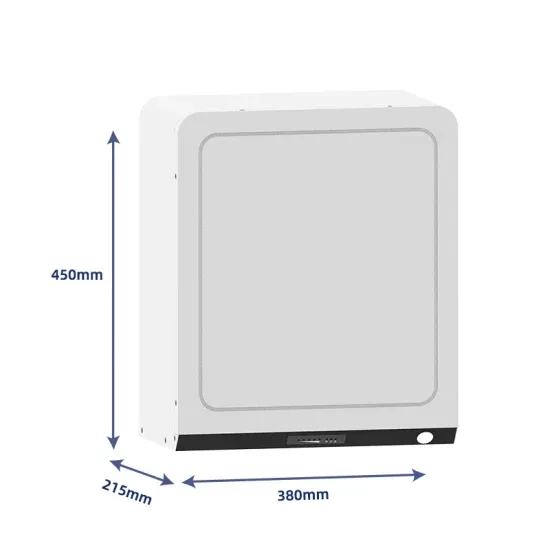

Product Information

Marshall Fire Accessory and Other Structures Tax Rebate

The City has extended its use tax exemption program for impacted properties to any accessory or other structure that requires a city-issued permit as part of the rebuild. Common accessory

Product Information

Taxable Earnings

The Marshall Islands Social Security Administration (MISSA) is a component unit of the Republic of the Marshall Islands (RMI) that aims to provide its people pension benefits, security

Product Information

INCOME TAX ACT 1989

Exemption - Non-Resident Income Tax....................................................................... 18. 121. Tax holiday...................................................................................................................... 18.

Product Information

MARSHALL ISLANDS: Import Duties (RE & EE Equipments Exemption

Amendment of Section 206 of the Import Duties Act by adding a new section, Section 206A in order to provide exemption for the importation of Renewable Energy and Energy efficiency

Product Information

An Overview of the Tax System in the Marshall Islands

While residential properties are often exempt from property taxes, commercial properties may be assessed a tax rate of up to 1% based on their value. This encourages

Product Information

Minnesota Solar Incentives, Tax Credits and Rebates (2025

The federal solar investment tax credit (ITC) is the best financial incentive for most Minnesota homeowners to buy solar panels. Jump to insight

Product Information

Understanding Tax Incentives and Subsidies for Foreign

These incentives include tax exemptions, subsidies, and streamlined business registration processes, making it easier for foreign entities to establish a presence in the region.

Product Information

Export Preview | Digital Logistics Capacity Assessments

Exemption Certificate Application Procedure (Emergency Response) Non-registered organizations, without permanent presence in RMI, responding to an emergency can apply for

Product Information

MARSHALL ISLANDS: Navigating our Energy Future: Marshall Islands

Continue the import tax exemption for solar PV panels but do not actively promote it. Our intended measures for private solar PV are: [...] Continue the MEC technical rule that rooftop solar

Product Information

Republic of the Marshall Islands: Technical Assistance

The tax system of the Marshall Islands is relatively simple, but inefficient, being based on turnover taxes, import duties, and a personal income tax. Revenues are largely driven by grants, while

Product Information

MARSHALL ISLANDS: Navigating our Energy Future: Marshall

Continue the import tax exemption for solar PV panels but do not actively promote it. Our intended measures for private solar PV are: [...] Continue the MEC technical rule that rooftop solar

Product Information

Renewable energy tax incentives | Marshall Islands | Global law

Under the Omnibus Bill, the 30% ITC for eligible solar properties such as solar photovoltaic systems, solar water heating, solar space heating/cooling, and solar process heat are

Product Information

New York State''s Real Property Tax Law § 487

This law provides a 15-year real property tax exemption for properties located in New York State with renewable energy systems, including solar electric systems. This law only applies to the

Product Information

IMPORT DUTIES ACT 1989

(5) Notwithstanding any other provision in this Act to the contrary, the Marshall Islands Energy Company (MEC) shall be exempted from the payment of import duty tax on the import of all

Product Information

Taxes in the Marshall Islands: What You Need to Know

In particular, income made outside the territory of the Marshall Islands (which is extremely small, by the way) is not taxed and the corporate tax rate on domestically obtained

Product Information

MARSHALL ISLANDS: Import Duties (RE & EE Equipments

Amendment of Section 206 of the Import Duties Act by adding a new section, Section 206A in order to provide exemption for the importation of Renewable Energy and Energy efficiency

Product Information

IMPORT DUTIES ACT 1989

No import duty shall be levied on Renewable Energy equipments (initially, warranted solar hot water heaters, photovoltaic (PV) panels, array frames, regulators, inverters, complete solar PV

Product Information

NITIJELA OF THE RE.pUBLIC OF THE MARSHALL ISLANDS

5 (4) Any person who is granted exemption under Subsections (1) and (2) shall sign a 6 prescribed form that certifies the imported RE & EE equipment complies, and declares thereby

Product InformationFAQs 6

What taxes are not payable in the Marshall Islands?

The following taxes are fees are NOT payable in the Marshall Islands by non-residents of the jurisdiction including corporate entities: Corporate tax on foreign income. The following taxes and fees are payable in the Marshall Islands by non-residents: Corporate tax on domestic income (income made within Marshall Islands) – 10%.

Are there environmental taxes in the Marshall Islands?

The Marshall Islands has implemented certain environmental taxes aimed at promoting sustainable practices and mitigating environmental impacts. These taxes may apply to activities such as waste disposal, pollution, or the use of natural resources.

Is there VAT in the Marshall Islands?

Yes, there is. The residents of the jurisdiction pay the VAT at the rates from 2% to 4%. What is the corporate tax in the Marshall Islands? For resident companies, the corporate tax is 0.8% if the yearly profit does not exceed US$ 10,000 and it’s 3% if it does.

Is foreign income taxed in the Marshall Islands?

Income made in other jurisdictions is not taxed in the Marshall Islands. This is the main factor that attracts foreign business people to the island state. The following taxes are fees are NOT payable in the Marshall Islands by non-residents of the jurisdiction including corporate entities: Corporate tax on foreign income.

Is the Marshall Islands a tax haven?

Moreover, the Marshall Islands has established itself as an attractive offshore tax haven, offering certain tax incentives and exemptions aimed at foreign entities. This aspect makes its system distinctly different from those in more heavily taxed jurisdictions.

How is property tax calculated in the Marshall Islands?

Real property, which includes both land and structures, is subject to property taxation in the Marshall Islands. The appraised worth of the real estate is the basis for calculating the levy. Certain types of property may be eligible for discounts and exemptions. Compensation given to employees is subject to payroll taxes.

Related reading topics

- Weight of 4kWh outdoor power supply

- Barbados Energy Storage Capacity Price

- Cameroon energy storage power supply agent

- Saudi Arabia s outdoor communication power supply BESS has a full range of sizes and models

- 5kWh energy storage battery solar energy

- Uzbekistan backup energy storage battery

- Slovenia prices for photovoltaic energy storage power generation

- Tunisian new energy storage battery manufacturer

- Solar integrated container home use

- Poland has the most lithium battery cabinets

- Outdoor battery cabinet 250kwh

- Advantages and Disadvantages of Energy Storage Containers

- Which energy storage system is best in Iran

- Huijue outdoor battery cabinet BESS

- 30 000W photovoltaic grid-connected inverter

- Maldives Microgrid Power Station Power Generation BESS

- Types and prices of energy storage batteries

- Portable energy storage power supply prices in Estonia

- Energy Storage Power System Home Cost Specifications

- How many strings of 48v lithium battery pack should be used

- Somalia vanadium energy storage battery

- What are the wind power of mobile small communication base stations

- Three-level photovoltaic inverter

- Fire-fighting equipment for Vietnam power grid energy storage compartment

- Guatemala energy storage battery company

- Two photovoltaic grid-connected inverters

- Major manufacturers of photovoltaic energy storage power stations