Building a communication base station inverter grid-connected tax rate

Welcome to our dedicated page for Building a communication base station inverter grid-connected tax rate! Here, we have carefully selected a range of videos and relevant information about Building a communication base station inverter grid-connected tax rate, tailored to meet your interests and needs. Our services include high-quality solar microgrid systems and battery energy storage solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Building a communication base station inverter grid-connected tax rate, including cutting-edge solar microgrid systems, advanced battery energy storage solutions, and tailored solar power storage applications for a variety of industries. Whether you're looking for large-scale utility solar projects, commercial microgrid systems, or off-grid power solutions, we have a solution for every need. Explore and discover what we have to offer!

IRS updates tax treatment of interconnection payments

IRS policy since 1988 has been not to tax utilities in most cases when independent generators connect to the grid and reimburse the utility for the cost of substation

Product Information

Optimal configuration for photovoltaic storage system capacity in

Base station operators deploy a large number of distributed photovoltaics to solve the problems of high energy consumption and high electricity costs of 5G base stations. In this

Product Information

Publication 5886 (Rev. 3-2024)

Provides a tax deduction for the cost of energy eficiency improvements to commercial buildings, installed as part of the building envelope; interior lighting systems; or the heating, cooling,

Product Information

Investment tax credit for energy property under section 48

The ITC available for a taxpayer in a tax year is the ITC credit rate multiplied by the eligible basis of energy property placed in service during the tax year.

Product Information

FACT SHEET: Transmission Investment Tax Credit

An ITC would provide developers long-term investment certainty when building regionally-significant transmission, stimulating both rate-based and "merchant" lines — all

Product Information

IRS updates tax treatment of interconnection payments

PTC-eligible projects must have "commenced construction" by the end of 2021. This option is not currently available for new projects. Enter into a Power Purchase Agreement with a taxable

Product Information

Understanding Your Electric Grid: Policy and Incentives

PTC-eligible projects must have "commenced construction" by the end of 2021. This option is not currently available for new projects. Enter into a Power Purchase Agreement with a taxable

Product Information

FAQs ON GRID CONNECTED ROOFTOP SOLAR PV

In Grid Connected Rooftop or small SPV Systems, the DC power generated from SPV panel is converted to AC power using Power Conditioning Unit (PCU) and it is fed to the Grid of 220kv/

Product Information

Germany introduces new zero tax rate on photovoltaic systems

New Zero Tax Rate on Photovoltaic Systems in Germany – Introduction The world of taxation and renewable energy has seen a significant shift in Germany with the introduction of the zero VAT

Product Information

Residential Clean Energy Credit

File Form 5695, Residential Energy Credits with your tax return to claim the credit. You must claim the credit for the tax year when the property is installed, not merely purchased.

Product Information

GRID CONNECTED PV SYSTEMS WITH BATTERY

Note: PV battery grid connect inverters and battery grid connect inverters are generally not provided to suit 12V battery systems. 48V is probably the most common but some

Product Information

Rates of Depreciation as Per Income Tax Act, 1961

Rates of depreciation applicable for income tax purposes from assessment year 2003-04 to 2025-26. This guide includes rates for tangible and intangible assets, providing

Product Information

Grid Communication Technologies

The goal of this document is to demonstrate the foundational dependencies of communication technology to support grid operations while highlighting the need for a systematic approach for

Product Information

48E Tax Credit: Claiming the Clean Electricity ITC

These replace the technology-specific Energy Investment Tax Credit (section 48) and Renewable Electricity Production Tax Credit (section 45) which phased out at the end of

Product Information

Navigating the Final IRS Regulations for Investment Tax Credits:

The IRS and U.S. Department of the Treasury recently released the final regulations for the Investment Tax Credit (ITC) under Section 48 of the Internal Revenue Code.

Product Information

Solar Grid Connected | MINISTRY OF NEW AND RENEWABLE

Solar Grid Connected Grid Connected Overview: Solar power sector in India has emerged as a fast-upcoming section in last few years. It supports the government agenda of sustainable

Product Information

Grid Connected Photovoltaic Systems

3.1 Grid-connected photovoltaic systems Grid-connected PV systems are typically designed in a range of capacities from a few hundred watts from a single module, to tens of

Product Information

A comprehensive review of grid-connected solar photovoltaic

The state-of-the-art features of multi-functional grid-connected solar PV inverters for increased penetration of solar PV power are examined. The various control techniques of multi

Product Information

Grid Standards and Codes | Grid Modernization | NREL

The goal of this work is to accelerate the development of interconnection and interoperability requirements to take advantage of new and emerging distributed energy

Product InformationFAQs 4

What is the ITC available for a taxpayer in a tax year?

The ITC available for a taxpayer in a tax year is the ITC credit rate multiplied by the eligible basis of energy property placed in service during the tax year. Satisfies certain prevailing wage and apprenticeship requirements (“PWA requirements”).

Do utility reimbursements automatically disqualify interconnection costs for ITC eligibility?

Utility reimbursements no longer automatically disqualify interconnection costs for ITC eligibility. Instead, general income tax principles apply, offering flexibility in specific situations. Interconnection property is excluded from prevailing wage, apprenticeship, domestic content, and energy community requirements. 2.

Should mixed technology projects be exempt from aggregation?

Decline to exempt mixed technology projects (e.g., solar plus storage) from aggregation, meaning combined property must jointly meet bonus credit requirements. Clarify that a project is “placed in service” when its last energy property becomes operational. 3. The 80/20 Rule for Retrofits

What is a New York grid integration project?

The project requires collaboration with the New York Department of Public Service, New York State Energy Research and Development Authority, New York Power Authority, and New York investor-owned utilities and provides technical expertise, research, and testing methods to address grid-integration issues in New York State.

Related reading topics

- Home 15 kW solar power

- German string photovoltaic inverter

- Sierra Leone Multi-Energy Solar Energy Storage Cabinet Quote

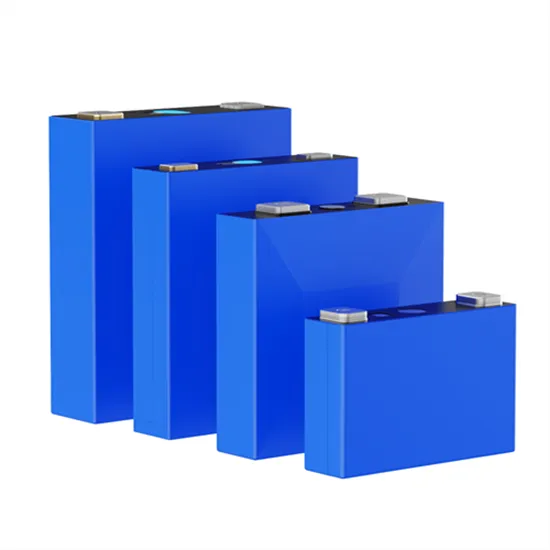

- A group of seven lithium iron phosphate battery packs

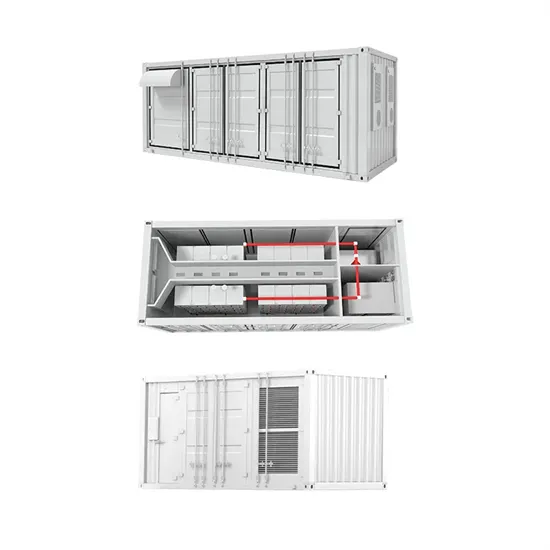

- Telecom container energy storage cabinet price

- Annual return on solar photovoltaic panels

- All-vanadium redox flow battery is affected by temperature

- Photovoltaic charging and discharging inverter

- Huawei Energy Storage Project Company

- Liquid-cooled energy storage and containerized energy storage

- Laos communication base station EMS company rankings

- China Solar Energy Storage Cabinet Supplier

- Timor-Leste lithium-ion battery energy storage container

- What are the types of energy storage battery parameters

- Solar panel curved surface

- Battery Energy Storage in 2025

- German rooftop solar system brand

- Benin DC Inverter

- East Asia Outdoor Battery Cabinet BESS

- How big is the inverter high voltage output

- Photovoltaic panel manufacturers in Albania

- How many volts are enough for home use of solar panels and photovoltaic panels

- Does the photovoltaic panel measure voltage

- Onsite energy conversion to solar power generation

- 2000kw site energy storage container

- Communication base station inverter grid-connected battery in the United States

- How much is the storage capacity of the outdoor power supply