Does installing photovoltaics qualify as an energy storage project

Welcome to our dedicated page for Does installing photovoltaics qualify as an energy storage project ! Here, we have carefully selected a range of videos and relevant information about Does installing photovoltaics qualify as an energy storage project , tailored to meet your interests and needs. Our services include high-quality solar microgrid systems and battery energy storage solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Does installing photovoltaics qualify as an energy storage project , including cutting-edge solar microgrid systems, advanced battery energy storage solutions, and tailored solar power storage applications for a variety of industries. Whether you're looking for large-scale utility solar projects, commercial microgrid systems, or off-grid power solutions, we have a solution for every need. Explore and discover what we have to offer!

Publication 6045 (Rev. 2-2025)

Tax-Exempt Entities and the Investment Tax Credit (§ 48 and § 48E) Tax-exempt and governmental entities, such as state and local governments, Tribes, religious organizations,

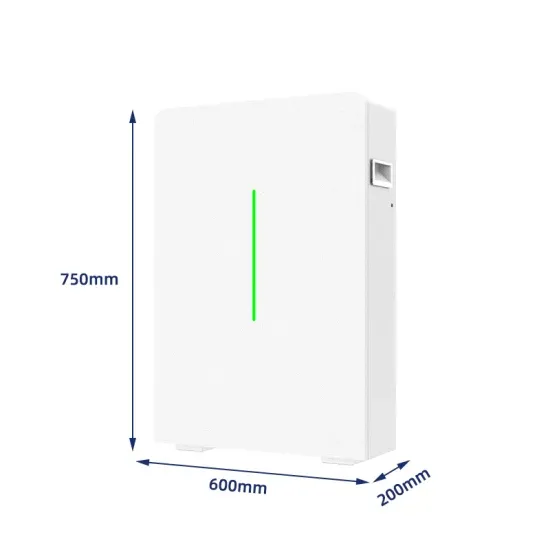

Product Information

FOR HOME | RESIDENTIAL SOLAR

The incentives for residential solar photovoltaic systems are dependent on the size, azimuth and other factors of your installed system. Homeowners will need to install solar photovoltaic

Product Information

The solar energy credit: Where to draw the line?

In Letter Ruling 201809003, the taxpayer requested a determination whether "the cost of installing certain energy storage property to be integrated into other residential solar

Product Information

Final Regulations: Clean Energy Investment Tax Credit

Energy storage technology is eligible for the §48 credit if it satisfies the requirements, notwithstanding that it may be co-located or shared by a facility that is otherwise

Product Information

Homeowner''s Guide to the Federal Tax Credit for Solar

Yes, but if the residence where you install a solar PV system serves multiple purposes (e.g., you have a home ofice or your business is located in the same building), claiming the tax credit

Product Information

What Is the 2024 Federal Solar Tax Credit?

Eligible systems include solar photovoltaic (PV) systems, which convert sunlight into electricity. To qualify, the solar energy system must be installed and operational within the

Product Information

Contents SGIP Equity and Equity Resil

The customer does not necessarily need to qualify for Equity to be eligible for Equity Resiliency as the customer may qualify under criteria one of four residential criteria. I have applied to one of

Product Information

What are the eligibility requirements for energy storage projects to

Eligibility for tax credits on energy storage projects varies depending on whether they are residential or commercial/industrial. Here are the eligibility requirements for each

Product Information

What the budget bill means for energy storage tax credit eligibility

In practical terms, this means developers must either begin construction by the end of 2025 to qualify for safe harbor rules or only source most of their materials from U.S. or

Product Information

Solar Energy Systems Tax Credit

Solar Panels or Photovoltaic Systems are solar cells that capture light energy from the sun and convert it directly into electricity. Use this buying guidance to learn more about your options,

Product Information

Residential Clean Energy Credit

If you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage technology, you may qualify for an annual residential clean energy tax

Product Information

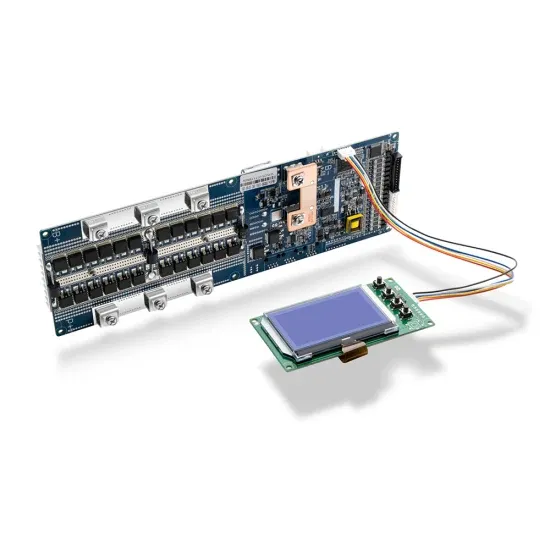

Battery Energy Storage Systems

Battery Energy Storage Systems Staff have prepared four options for committee consideration and provided information that supplements CSLB''s review of the appropriate classification to

Product Information

Understanding the Solar Battery Tax Credit in 2023

If you install solar battery storage in a subsequent tax year to when your solar panel system was installed it may still be eligible for the solar tax credit. However, the energy

Product Information

Inflation Reduction Act Creates New Tax Credit Opportunities for Energy

Energy storage projects could claim the ITC only when installed in connection with a new solar generation facility, and then only to the extent the energy storage project was

Product Information

Federal Solar Tax Credit: All You Need to Know – VTOMAN

Battery Storage Technology: Starting in 2023, the Inflation Reduction Act expanded the ITC to include standalone energy storage systems (such as battery storage)

Product Information

Tax Credit for Solar Panels: What Is it and How Does

Discover how to qualify for a tax credit for solar panels and how to maximize savings. We''ll also help guide you through the tax credit application

Product Information

How to Qualify for SGIP Incentives and Maximize Your Savings

The Self-Generation Incentive Program (SGIP) is a California initiative designed to encourage the adoption of renewable energy and energy storage technologies. Managed by the California

Product Information

Final Regulations: Clean Energy Investment Tax Credit

Energy storage technology is eligible for the §48 credit if it satisfies the requirements, notwithstanding that it may be co-located or shared by a

Product Information

Solar Energy Technologies Office

Solar technologies convert sunlight into electrical energy either through photovoltaic (PV) panels or through mirrors that concentrate solar radiation. This energy can be used to generate

Product Information

Can You Use The Investment Tax Credit (ITC) For

What About Adding Storage to an Existing PV System? If a homeowner wants to add storage to their existing PV system, it may still qualify for the ITC! In a

Product Information

California Solar Permitting Guidebook

To qualify under this statutory exemption, a solar energy project must be located either on the roof of an existing building or on an existing parking lot. SB 226 makes clear the legislative intent

Product InformationFAQs 6

Does a solar photovoltaic system qualify for a qsepe tax credit?

In Letter Ruling 201809003, the taxpayer requested a determination whether “the cost of installing certain energy storage property to be integrated into other residential solar photovoltaic system property will qualify as [QSEPE] eligible for the tax credit under §25D.”

Can I claim a tax credit if I install a solar PV system?

Yes, but if the residence where you install a solar PV system serves multiple purposes (e.g., you have a home ofice or your business is located in the same building), claiming the tax credit can be more complicated.

Does a photovoltaic system have to be used in a home?

The water must be used in the dwelling. Photovoltaic systems must provide electricity for the residence, and must meet applicable fire and electrical code requirements. Tax Credit includes installation costs. The home served by the system does not have to be the taxpayer's principal residence.

Who is eligible for a solar PV tax credit?

A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit.

Are photovoltaic systems tax deductible?

Photovoltaic systems must provide electricity for the residence, and must meet applicable fire and electrical code requirements. The home served by the system does not have to be the taxpayer's principal residence. Find products that are eligible for this tax credit.

Can I claim a solar PV tax credit in 2021?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house (assuming the builder did not claim the tax credit)—in other words, you may claim the credit in 2021.

Related reading topics

- Taipei Multi-functional Communication Base Station Hybrid Energy Manufacturer

- Huawei Mauritania Energy Storage Project Company

- Oman Addis Ababa Communications 5G base station

- Application of liquid cooling in energy storage

- Israel 5G communication base station inverter planning

- Romanian energy storage system production company

- Portugal s rooftop solar power system

- Ukrainian new energy battery cabinets and modules

- Chad New Energy Storage Company

- Customized battery cabinet battery rack base station

- Container solar energy 5kWh

- Mechanical Home Energy Storage

- Major Energy Storage Projects

- Household low-temperature resistant solar integrated machine

- German industrial energy storage cabinet model

- Working principle of energy storage cabinet

- Huawei Thailand energy storage products

- New Zealand s commercial and industrial photovoltaic energy storage

- Where can I buy energy storage cabinet containers

- Nigerian rechargeable energy storage vehicle equipment manufacturer

- Thailand distributed energy storage system

- Base station battery connection method

- Huawei s latest energy storage battery system project

- Algeria high voltage inverter production

- Which manufacturers are there for energy storage cabinet production equipment

- Photovoltaic 150 kWh energy storage battery

- Sri Lanka portable energy storage battery